Whether you’re traveling to Europe for two weeks or planning an epic round-the-world adventure, you need travel insurance.

Seriously.

I know, it’s not a fun topic to read about. And yes, it will add to your travel budget. But after almost two decades on the road, I’ve learned the hard way just how important travel insurance can be.

I’ve had my luggage lost, I’ve popped an eardrum, and I’ve even been stabbed. Throw in countless delayed and cancelled flights and I’d be out thousands upon thousands of dollars.

Fortunately, I had travel insurance. They were there to help me navigate the problems and ensure I didn’t go broke paying for emergency expenses.

These days, SafetyWing is my go-to travel insurance company. I’ve been using them for years and have found their plans to be super affordable, their customer service fast and friendly, and their coverage to be sufficient for what I need.

Currently, SafetyWing offers two plans for travelers:

- Nomad Insurance Essential

- Nomad Insurance Complete

While both plans are great, they are each designed for specific kinds of travelers. In this post, I’ll break down what each plan covers and who it is for so you can decide which plan is best for your next trip.

The SafetyWing Essential Plan

This is the main travel insurance plan from SafetyWing. It’s designed for travelers who want basic coverage without breaking the bank. It’s the plan I use when I travel these days.

The plan costs just $56.28 USD for 4 weeks (for travelers aged 10-39). That’s one of the lowest prices out there for reliable travel insurance. They are super competitive when it comes to price.

For comparison, similar plans from other companies are double that (or more). The plan is suitable for travelers up to age 69, though travelers 60–69 will be paying $196.84.

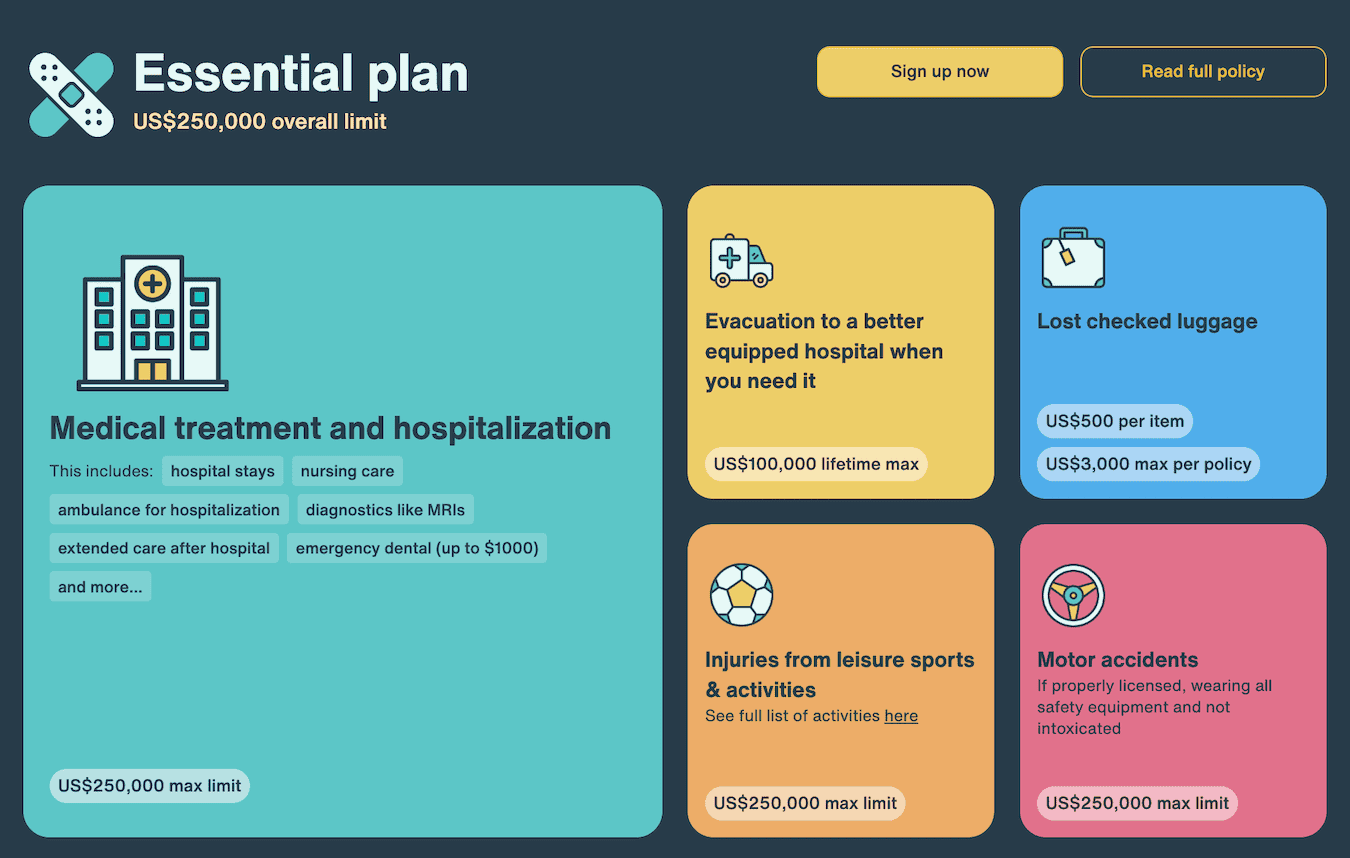

Here is what the Essential plan covers at a glance:

- $250,000 for emergency medical treatment and hospitalization

- $100,000 for medical evacuation

- $250,000 for motor accidents

- Up to $3,000 for lost luggage ($500 per item)

- $10,000 for evacuation due to political unrest

- $5,000 for trip interruption

- $200 for travel delay ($100 per day for two days)

They also have three helpful add-ons:

- Coverage for adventure sports

- Coverage if you’re visiting the US

- Coverage for electronics theft

Since not everyone needs these, I like that they are available as add-ons. Personally, I always need extra electronics coverage, but I never need coverage for adventure sports since I am pretty much the opposite of an adrenaline junkie. I like that I can customize the plan to suit my travel plans/travel style.

Who is the essential Plan For?

SafetyWing’s primary plan is great for a wide range of travelers. Here are the kinds of travelers that I think the policy is best for:

Backpackers – I think the Essential’s plan is the best travel insurance plan for travelers on a budget. It’s what I use when I travel these days because it balances affordability with coverage. At just a couple bucks per day it won’t break the bank and it has coverage for all the most serious potential emergencies.

Budget & Midrange Travelers – If you’re traveling to Europe for a few weeks or heading to the Caribbean for a relaxing holiday, this plan is for you. It balances cost with emergency coverage, as well as some coverage for things like delays and cancellations.

The SafetyWing Complete Plan

The Complete plan is insurance for digital nomads, remote workers, and long-term travelers. It’s a mix of your standard emergency coverage (similar to the Essential plan above) but it also includes “regular” non-emergency coverage.

So, not only does the plan cover things like emergency injuries and illness but it also includes routine visits and preventive care. It’s a replica of the kind of health insurance you might find in your home country, ensuring that you’re looked after no matter what happens.

The plan costs $150.50 for 4 weeks (for travelers aged 18–39). It’s available to travelers up to age 64.

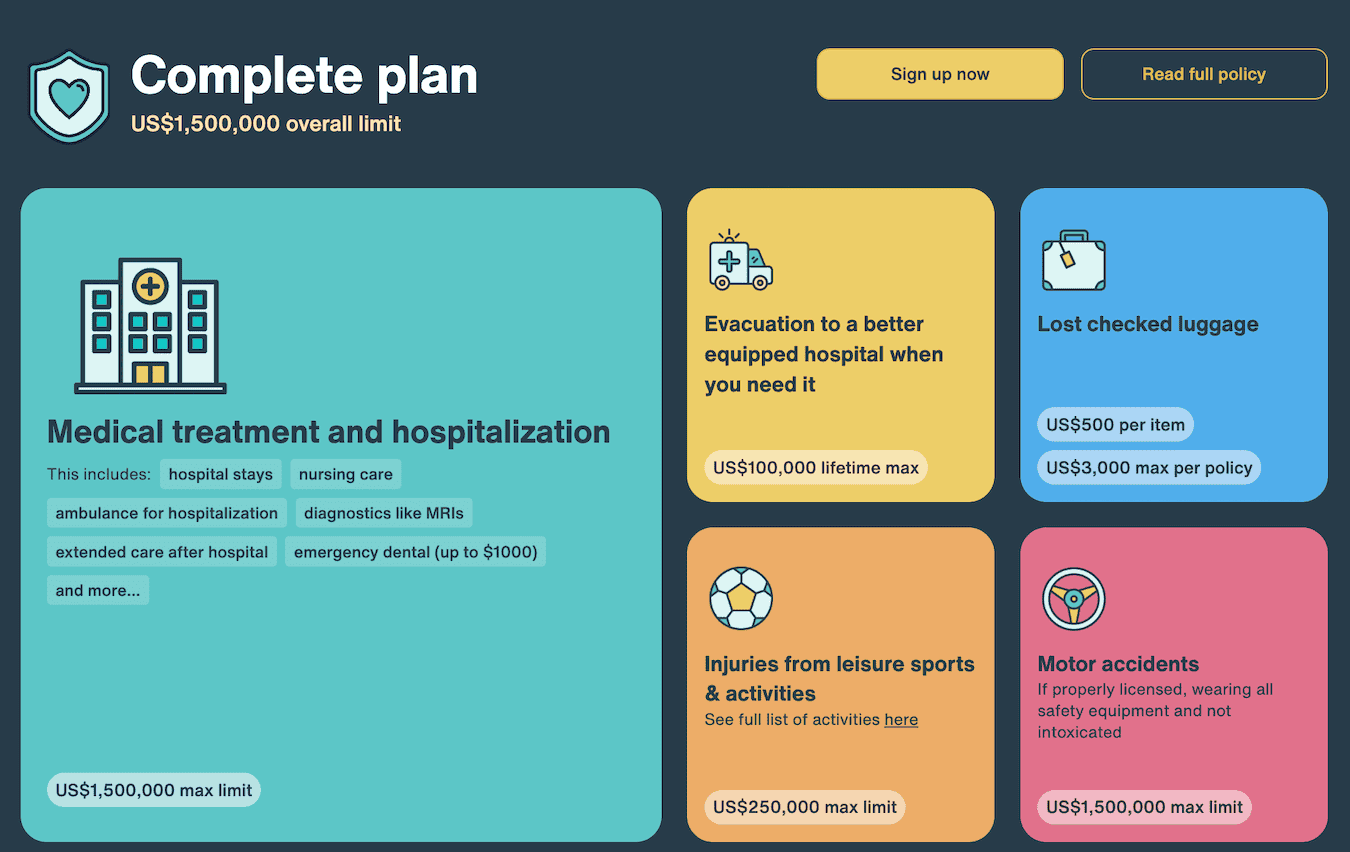

Here’s a look at what the plan covers for emergencies:

- $1,500,000 in coverage for medical emergencies

- $100,000 for medical evacuation

- $1,500,000 for motor accidents

- Up to $3,000 for lost luggage ($500 per item)

- $10,000 for evacuation due to political unrest

- $5,000 for trip interruption

- 150 per day for travel delay (up to three days), $60 for delays over three hours

- $100,000 for accidental death

Overall, the emergency coverage of this plan is similar to the Essential plan, but expanded and with higher limits.

Here’s a look at the plan’s more “standard healthcare” coverage:

- $5,000 for doctor visits (dermatologist, gynecologist, etc.)

- $300 for routine check-ups

- 10 psychologist or psychiatrist visits per year

- $1,500,000 for cancer treatment

- $2,500 for maternity care

- $5,000 for wellness treatment

- $5,000 for stolen belongings

As you can see, the Complete plan is much more robust than the Essential plan. It’s the plan I wish I had when I first started backpacking full-time because it’s just so comprehensive. If I was working remotely overseas full time, this is the plan I would use.

Additionally, new conditions such as diabetes or asthma are covered under the Complete plan (under Essential, they become pre-existing conditions). That’s something not a lot of other companies offer, which I think is a huge plus.

One important difference between the Complete and Essential plans, however, is that, unlike regular travel insurance, Nomad Insurance Complete applicants must be approved. You can’t just buy a plan and be on your merry way, as the insurance team needs to review your application, along with any medical history and/or pre-existing conditions. They may also request additional medical notes or documents.

While I don’t love that some people are likely to be screened out and you can just buy a plan with a click and be on your way, I understand the reasoning given the cost of health care around the world.

Who is the Complete Plan For?

SafetyWing’s Complete plan is perfect for three kinds of travelers:

Long-Term Travelers – If you’re planning to travel for a year or more, this is the plan for you. It will ensure you have coverage for emergencies, as well as for routine check-ups. And the higher coverage limits for delays and cancellations are a must for those traveling often.

Digital Nomads – If you’re going to be traveling and working, you’re going to want emergency coverage with a high limit. The wellness coverage the Complete plan includes is also a nice touch.

Expats – If you’re living abroad for some (or all) of the year, you’ll want to have access to both emergency coverage as well as regular check-ups. The evacuation coverage is a must too should you be living in more turbulent regions.

I never leave home without travel insurance. For just a few dollars a day, you not only ensure you don’t go bankrupt should an emergency occur, but you’ll also get peace of mind knowing that you have help and support should something happen.

Whether you’re a budget backpacker looking for a basic plan or a seasoned digital nomad who needs robust healthcare, SafetyWing has you covered.

Use the widget below to get a free quote:

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.