Prediction market Polymarket is getting ready to make its way back into the US in the next few weeks, and Bloomberg says the company plans to focus mainly on sports betting.

People familiar with the plans, who asked not to be named because the information is confidential, said the first trades will likely happen by the end of November, although the platform will not be open to everyone right away. If the timing holds, Polymarket could take advantage of the busiest stretch of US football and basketball. As of now, neither Polymarket nor the Commodity Futures Trading Commission has responded to ReadWrite’s requests for comment.

Is Polymarket legal in the US?

Polymarket has been barred from operating in the US since 2022 after settling allegations of illegal trading with the CFTC. It has also been restricted in the United Kingdom, Australia, France, Ontario, Singapore, Poland, Thailand, Belgium, and Taiwan. But the company has been pushing to expand again. In recent months, it struck a deal worth $112 million as part of its international growth and planned US return.

Last month, the CFTC gave it what has been described as a green light to come back, and the company is reportedly looking to raise money at a valuation between $12 and $15 billion.

Polymarket currently has a waitlist for users, with the company saying the platform will open soon. On its website, it tells people, “We’re working hard to get the US platform ready for launch — in the meantime, provide your phone number below to receive updates.”

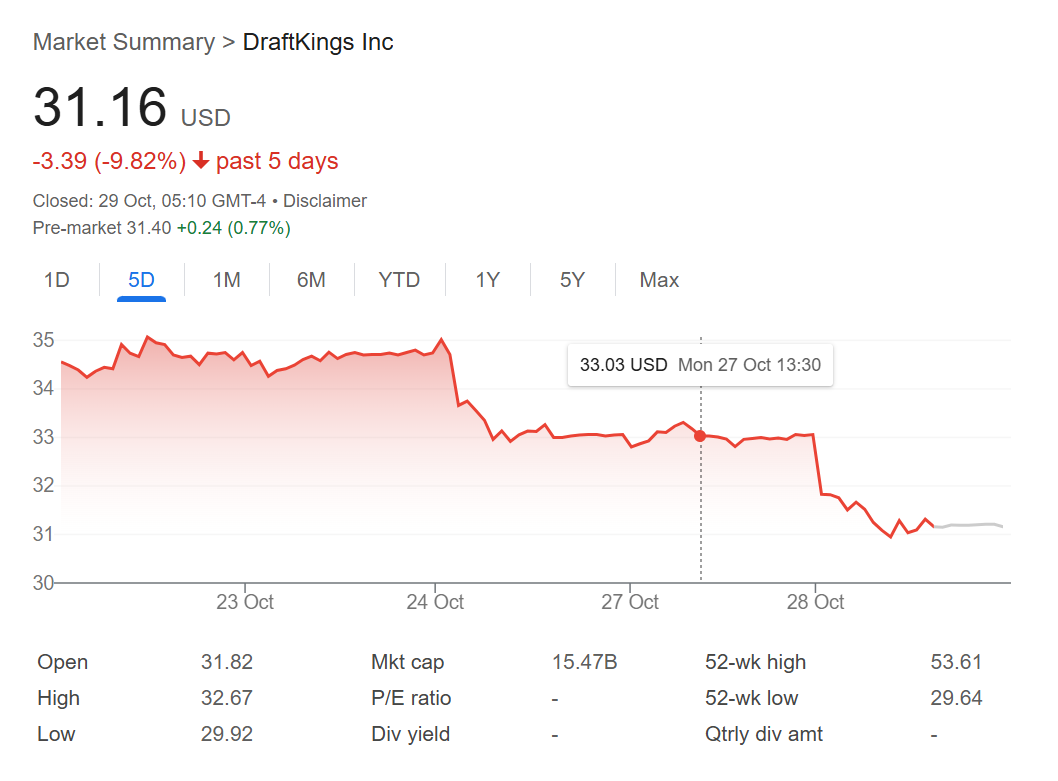

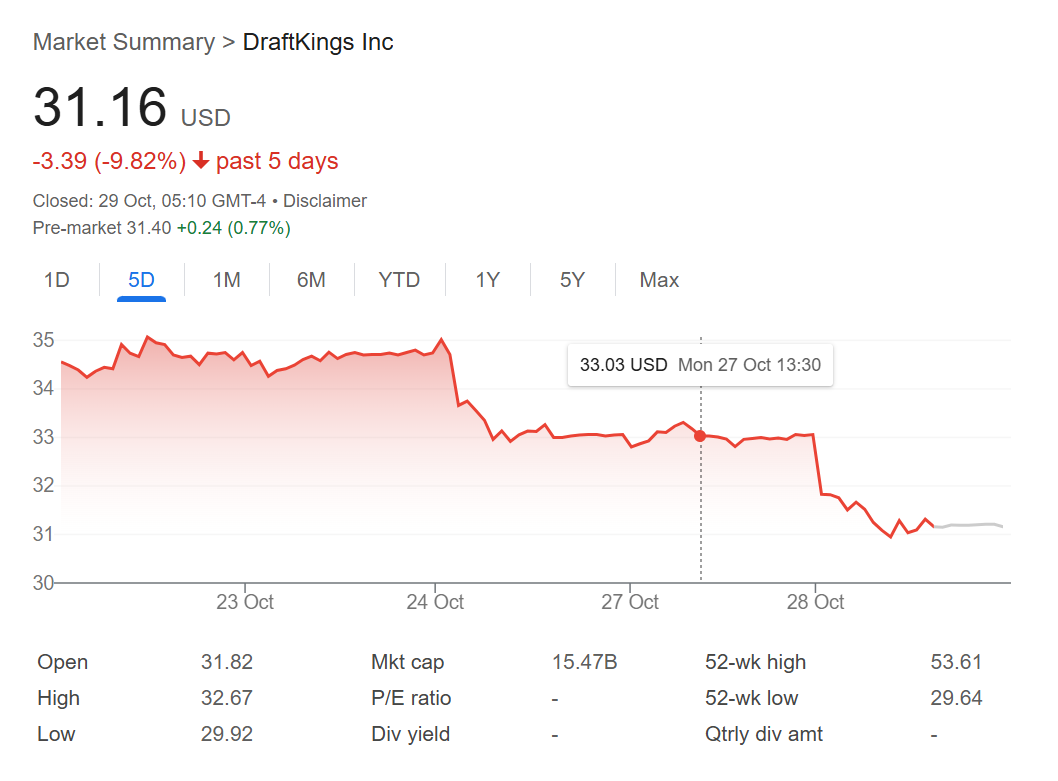

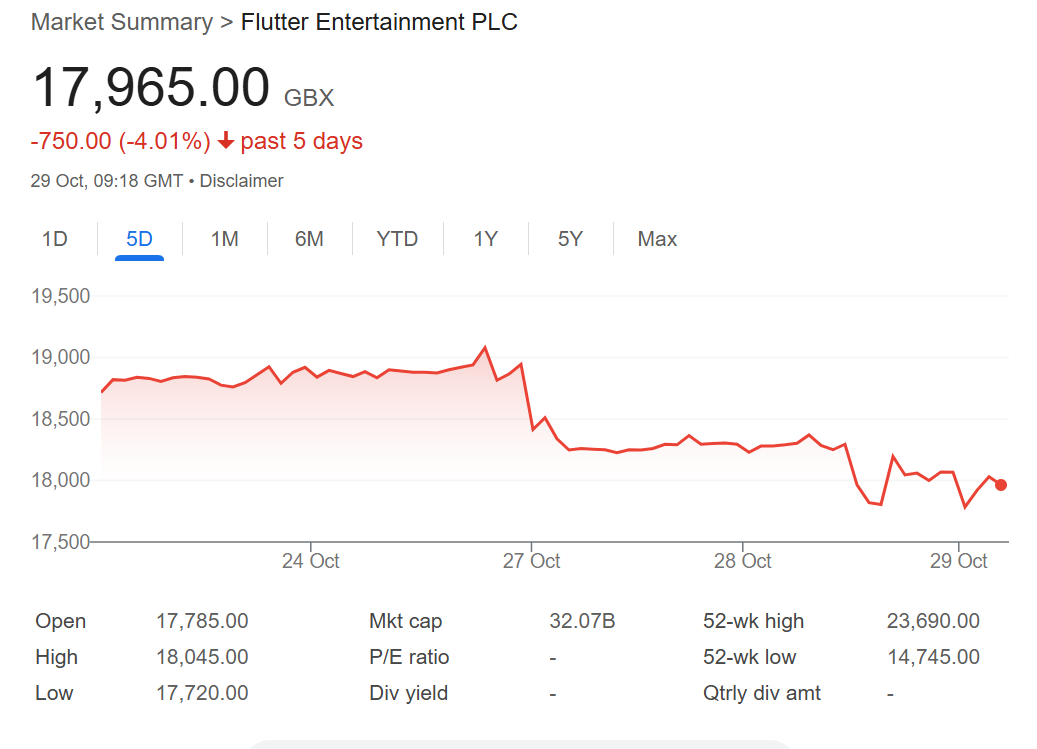

Market reaction

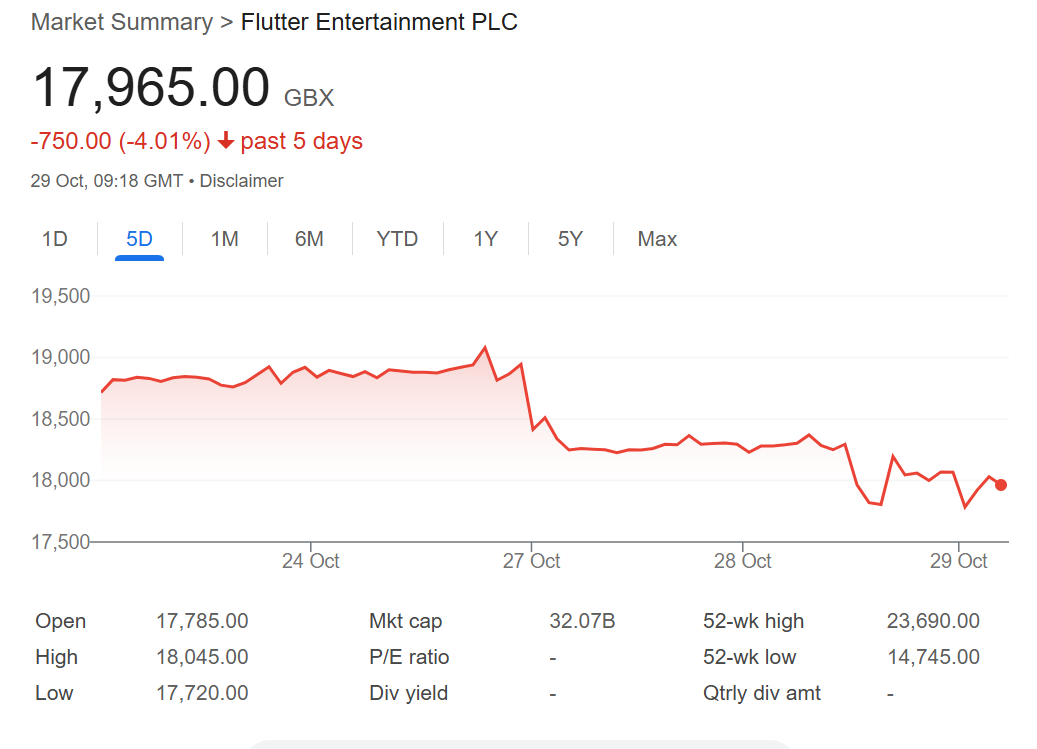

US gambling stocks took a hit after Bloomberg’s initial report. DraftKings dropped as much as 9.2%, and Flutter Entertainment, the parent of FanDuel, slid as much as 4.7%. They had already been trading lower after Donald Trump’s social media company said it planned to enter the betting space through a partnership with Crypto.com, one of Polymarket’s competitors.

The market has grown exponentially since Polymarket’s rival, Kalshi Inc., won a court case last year that allowed it to offer event contracts on the presidential election. Kalshi’s value has climbed sharply as well. It recently moved into sports betting, taking on traditional sportsbooks and apps like DraftKings and FanDuel. In its first week of NFL wagering, the platform reportedly brought in more revenue than it did during the presidential election.

Still, Kalshi is not without its own legal battles. It has sued New York’s gaming commission, arguing the agency is overstepping by trying to regulate sports betting that should fall under federal oversight. Polymarket could end up dealing with similar challenges once it is back in the US.

Featured image: Canva / Polymarket