An indictment has been unsealed in a case involving a crypto casino founder and his alleged gambling away of millions of investor funds. The news comes from the desk of the United States Attorney for the Southern District of New York, Jay Clayton.

Clayton is working alongside the Assistant Director in Charge of the New York Field Office of the Federal Bureau of Investigation (FBI), Christopher G. Raia.

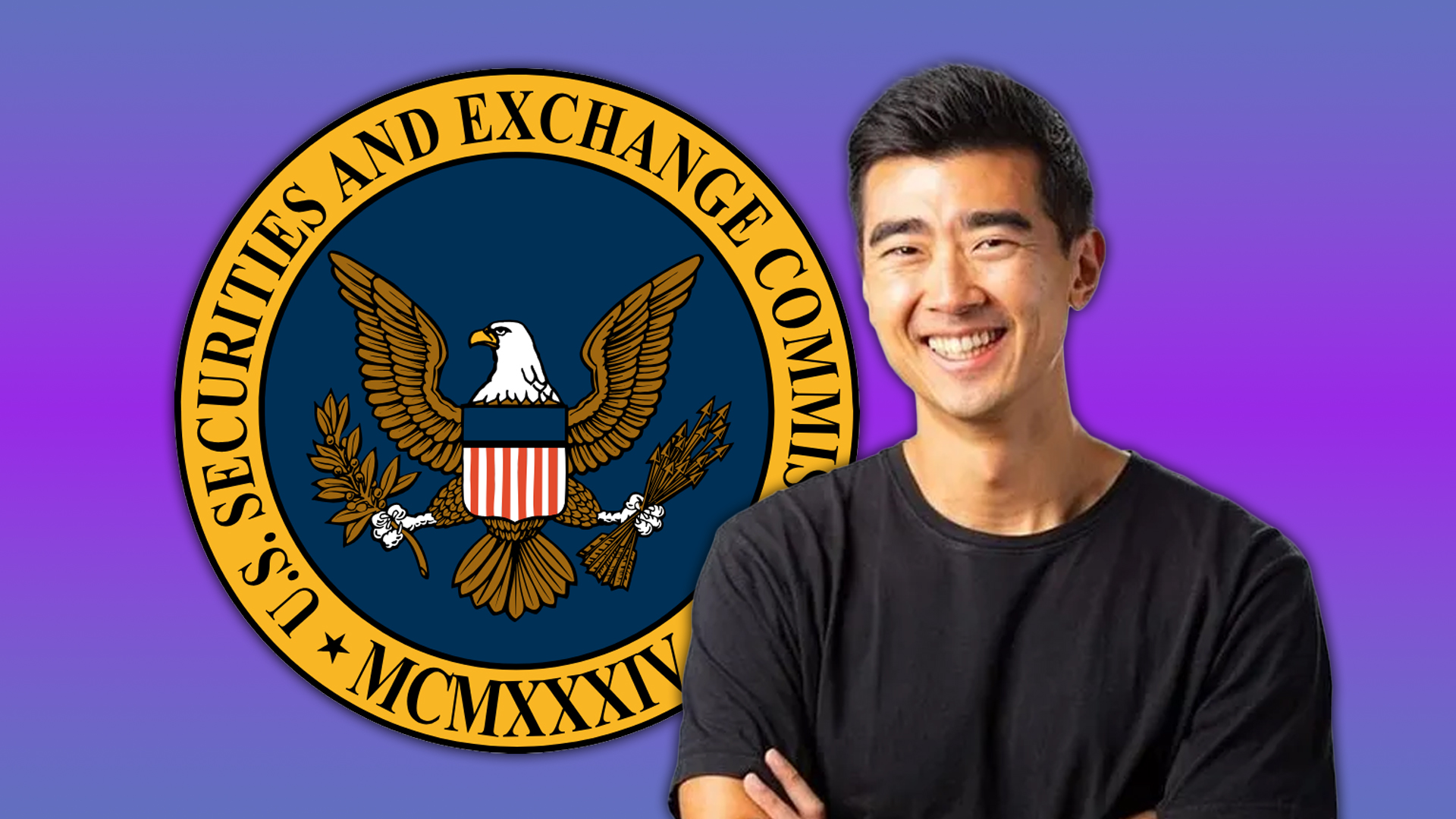

They have laid charges at the door of the former founder and Chief Executive Officer of Zero Edge Corporation (Zero Edge), Richard Kim. U.S. District Judge Lorna G. Schofield will oversee the proceedings and outcome of the case.

Kim indicted in crypto casino gambling case

Kim is being charged with masterminding a process to defraud investors of Zero Edge by the authorities and the Securities and Exchange Commission (SEC) as part of the Securities and Exchange Commission v. Richard T. Kim, No. 1:25-cv-03796 (S.D.N.Y. filed May 7, 2025).

These charges include “making false and misleading statements regarding the use of investor funds and subsequently misappropriating those funds,” according to the DOJ report.

These serious charges of securities fraud and one count of wire fraud each carry a maximum sentence of 20 years in prison. Assistant U.S. Attorney Ryan T. Nees will prosecute the case, and the filing of the case will be handled by the Office’s Securities and Commodities Fraud Task Force.

Kim’s alleged misconduct

Zero Edge was founded by Kim in 2004 with the view to utilizing blockchain and cryptocurrencies to fuel a casino app. It is reported that Kim made assurances to potential investors that the app would be developed with their investment.

The DOJ’s information and subsequent charges say that Kim did otherwise with the proceeds of his funding rounds. Instead of developing “on-chain” games such as craps and potentially bacarat, blackjack, and roulette at a later stage, he is accused of mishandling these investments.

The indictment documents point the finger at Kim, saying he “misappropriated the proceeds of the company’s seed round to make speculative cryptocurrency trades and gamble at an online casino.”

Zero Edge funding rounds

The DOJ reported that Kim and Zero Edge closed on approximately $4.3 million seed financing round from investors.

Further to this, Kim is alleged to have “diverted approximately $3.8 million of investors’ funds first into a personal cryptocurrency account held at Coinbase and then sent approximately $1 million on to a variety of other crypto exchanges, including Binance, Kraken, and Backpack.”

The indictment goes further into the alleged deeds of Kim from June 21, 2024, to June 27, 2024. In this timeframe, Kim made transfers of $7 million and net transfers of $1 million, from “Coinbase and Kraken to a personal account held at a casino and sportsbook website, Shuffle.”

The records presented by the DOJ show that Kim transferred approximately $450,000 to other cryptocurrency wallets with unknown owners and transferred an additional $145,000 from Kraken to a personal checking account.

Emails show admission of guilt

In emails presented as part of the indictment, Kim contacted investors, saying he was “solely responsible for the loss of $3.67m of the company’s balance sheet.”

Despite this admission of guilt, he allegedly concealed the reason for the losses, saying it was not gambling losses, it was part of “leveraged trading losses from seed round financing proceeds” and was a “treasury management strategy.”

The FBI reported that at the time of his arrest he declared that these actions were “clearly wrong from the beginning” and “completely unjustifiable.”

Featured image credit: Ideogram.