Gemini may be getting ready to deepen its push into regulated event-based trading through its affiliated platform, Gemini Titan. A recent regulatory filing submitted to the U.S. Commodity Futures Trading Commission, along with internal compliance documents, lays out how the company plans to structure a federally compliant prediction market and affiliated trading framework

People familiar with the strategy say the timing lines up with major changes underway at Gemini Space Station, Inc., the publicly traded parent company founded by Cameron and Tyler Winklevoss.

In its filing posted by Sportico’s Dan Bernstein, Gemini spells out strict guardrails for any affiliate that wants to trade on the platform. The company says those affiliates “have access to the Platform on terms and conditions that are not preferential relative to other Participants, including compliance with all Rules” and “have not received capital from the Company.” It also states that affiliates “do not have access to the Company’s operations, including its servers, databases, accounts, or source code, except to the extent that other Participants have such access and, in that event, only on the same terms and conditions applicable to other Participants.”

Beyond access and capital limits, the filing requires that affiliates “act in a fair and responsible manner in all of its activities on the Platform” and disclose “to the Company of any actual or potential conflicts of interest in its operations, algorithms, or systems.” Taken together, the commitments are meant to show regulators that Gemini is building its prediction markets business with market integrity front and center.

Earlier, Gemini Titan secured a CFTC Designated Contract Market license, giving it the green light to list federally regulated event contracts for U.S. customers. The contracts let traders take yes-or-no positions tied to financial indicators or real-world developments, a niche that has quickly attracted attention from both traditional finance and crypto-native firms.

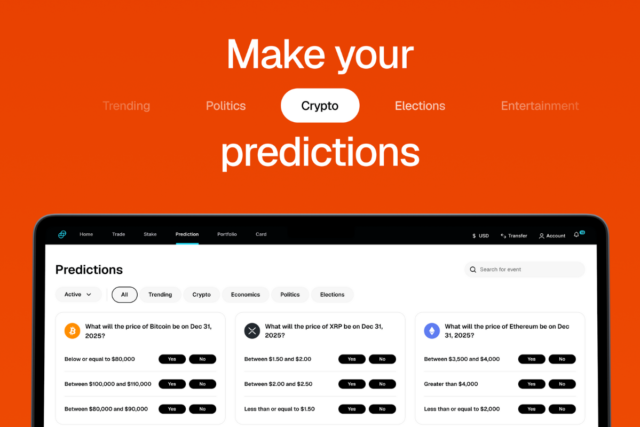

In December 2025, the company rolled out Gemini Predictions nationwide, making the platform available in all 50 states with near-instant execution. Gemini described that launch as the end of a five-year regulatory journey.

Gemini Titan’s parent company turbulence raises investor concerns despite prediction markets strategy

The expansion into prediction markets comes as Gemini Space Station, Inc. navigates a rocky stretch. Shares of the company, which trade under the ticker GEMI on Nasdaq, fell more than 13% after it disclosed that Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen, and Chief Legal Officer Tyler Meade were leaving only months after the firm’s September 2025 IPO.

In filings with the U.S. Securities and Exchange Commission, the company said Beard’s departure was not the result of any operational disagreement. Interim leadership has stepped in, with Cameron Winklevoss taking on some COO duties. However, analysts characterized the developments as a “big shakeup” that rattled investors.

The executive exits followed aggressive cost-cutting, including a 25% reduction in staff and the wind-down of operations in the United Kingdom, European Union, and Australia as Gemini refocused on the U.S. market.

Even so, the company has continued to draw attention to the promise of prediction markets. When introducing the product, it said the platform would “offer event contracts that are simple yes or no questions on future events,” hoping to bring regulated transparency. It added: “Prior to the commencement of trading on the Platform by any Affiliate, the Company will put in place necessary controls to ensure compliance.”

Featured image: Gemini